This is Why Your New Small Business Needs Bookkeeping Now

As a new small business owner, you’re most likely facing the reality of all the hats one must wear as an entrepreneur. From managing operations to attracting customers and everything in between, bookkeeping might not be at the top of your priority list. I get it.

Some might think, I’m not earning anything right now, so why worry? Right? Well, this type of thinking can lead you down a path of intense frustration and significant consequences.

In this article, I will explain why bookkeeping is essential for small new business owners like yourself. I’ll discuss its benefits, the downside of neglecting it, and practical tips for getting started. For a deeper dive into mastering bookkeeping techniques and essential how-tos, be sure to check out my article on 22 must-know bookkeeping tips.

So, if you’re to establish a solid foundation for your business, keep reading!

Key takeaways:

- Learn why bookkeeping is vital for your business.

- Discover the benefits of maintaining accurate financial records.

- Avoid common drawbacks associated with neglecting your books.

- Get practical tips for implementing bookkeeping practices in your business.

So, What is Bookkeeping?

Bookkeeping is the practice of tracking every dollar that flows in and out of your business. It’s like having a financial roadmap that guides you through the twists and turns of your business journey.

It meticulously records all monetary movements within your business, allowing you to prepare accurate financial statements that reflect its health. These reports are essential because they give you a clear picture of where your business stands today, where you’ve been, and where you’re headed.

Why is Bookkeeping Necessary for Your New Small Business?

When starting your new business, you want to make sure you’re focusing your energy on the right approach for its success, especially when it’s just taking off. That is why bookkeeping is vital even at this point in your journey.

Take your business’s cash flow, for example. You must monitor this closely because not knowing how much money is going out versus how much is coming in and when could put you in a financial bind. This situation may arise where you don’t have enough cash to cover your operating expenses, potentially leading to desperation and decisions that could worsen your situation.

In addition, by keeping a close eye on your business finances early on, you can assess what’s working and what’s not. This allows you to adapt and make necessary changes as your business evolves.

And let’s not forget about tax time. Regardless of your business’s revenue, your accountant will require a detailed breakdown of all income and expenses for tax filing.

So, bookkeeping is not just a chore. It lays the groundwork for your business’s financial health and future growth.

What are the Benefits of Bookkeeping for your New Small Business?

If you still need to figure out the benefits of bookkeeping, let me break it down for you.

First, bookkeeping is essential for operating your business effectively. Providing a clear financial picture empowers you to understand your business’s standing and navigate its growth effectively.

For instance, it can pinpoint areas where your services or products are not profitable and are costing you more than they earn. It also helps identify unnecessary expenses that are draining your resources. Whether it’s something you no longer need or an opportunity to find a better deal, bookkeeping enables you to make informed decisions about your business’s finances, including investments in machinery or other significant expenses.

Beyond providing valuable data, maintaining accurate bookkeeping records keeps you in compliance with IRS regulations. This compliance shields you from costly mistakes that could result in fines, interest, and fees, particularly during tax time.

And another big one, bookkeeping, serves as your initial defense against discrepancies and fraudulent charges. Detecting these issues early on safeguards your business’s financial integrity and spares you from potential headaches in the future.

So, bookkeeping is a must to set your business up for success!

What if a New Small Business Decides to Neglect its Books?

Now that we’ve explored the benefits of bookkeeping, I believe that as a new business owner, it’s equally important to address the consequences of neglecting your books. Because whether you are new or have been in the game for a few years, the repercussions apply to all.

#1: Operating in the dark. Neglecting to track your business income and expenses accurately can lead to financial chaos and missed opportunities for cost-saving. This oversight may even pave the path to bankruptcy, as cash flow remains the primary reason behind the downfall of many small businesses.

#2: Potential legal entanglements. Neglecting your books can lead to bookkeeping errors, opening the door to potential legal issues, including non-compliance with tax regulations and financial reporting requirements. This oversight could result in audits, fines, or even legal action, jeopardizing your business’s stability and reputation.

#3 Poor decision-making. Without bookkeeping and accurate financial information, making informed decisions about budgeting, pricing, and resource allocation becomes challenging. This lack of clarity can hurt business growth and make assessing your company’s financial health difficult. Moreover, inaccurate financial reporting can erode trust with stakeholders, including investors, lenders, and suppliers, potentially damaging your business’s reputation in the long run.

How to get Started with Bookkeeping?

Now that you know how important it is to practice good bookkeeping in your business. Here are a few actionable steps that will help you get started.

Choose the Right Accounting Software for You

I firmly believe in the efficiency of online tools for financial management. While spreadsheets and proper document filing can also be effective, going digital offers the quickest and easiest way to keep track of your finances.

I use QuickBooks, a leading choice in the industry. However, other excellent resources like Xero, Freshbooks, and more exist. Take the time to research and choose the platform that aligns best with your business needs and preferences. Consider factors like pricing, features, and scalability.

Set up Your Account

There are several steps to take during this stage, which can vary depending on your industry. However, in general, the following steps apply to all businesses.

- Choose an accounting method: Decide whether you’ll use the cash or accrual method. The cash method records transactions when money physically exchanges hands. It is ideal for small businesses with straightforward finances, like a freelance graphic designer who gets paid immediately upon completing a project. On the other hand, the accrual method records transactions when they’re incurred, regardless of when the money is exchanged. This method suits businesses that deal with inventory or have long-term projects, such as a retail store that sells products on credit and needs to track inventory levels accurately.

- Set up your chart of accounts: This is like the backbone of your bookkeeping system. It’s a comprehensive list of all your accounts, including assets, liabilities, revenue, and expenses. Each account serves as a category for organizing your financial transactions, making it more straightforward to comprehend your reports. When creating your Chart of Accounts, consider what information you want to see when analyzing your reports. You can make it as detailed or straightforward as you prefer, tailored to your business’s specific needs and preferences.

- Set up your products and services: Here you will create a list of services or products you sell. By making a thorough list of what you sell and it’s pricing, you’re making invoicing more efficient, organized, and valuable for the tracking of the success per product or service offered. One important thing to double-check is that each item matches the right income category. Be cautious with this step to avoid mistakes that could mess up your financial reports later on.

- Connect all business bank accounts: Linking your business bank accounts to your accounting software streamlines transaction recording. It allows for automatic importation of your bank activity, reducing manual data entry and minimizing errors.

- Add opening balance to each account: This step involves entering the initial amounts for each account when you first set up your bookkeeping system. It establishes a starting point for tracking your financial activity going forward.

- Customize your forms: Customize your invoices, receipts, and other financial forms to reflect your brand and meet your business’s needs. This personalization adds a professional touch and ensures consistency in your financial documentation.

Categorize Transactions Weekly

Once your account is set up and your bank accounts are connected, transactions will start appearing in your “bank feeds,” acting as a central hub for all incoming transactions from your bank account. Here, you’ll need to assign each transaction to its corresponding account.

Choose a specific day and time each week to categorize transactions to keep your accounts current and minimize any backlog.

Reconcile Accounts Regularly

To fully leverage the advantages of bookkeeping, it’s crucial to reconcile your accounts regularly—preferably monthly. Reconciling your accounts compares your recorded transactions with bank statements or other financial documents. While quarterly reconciliations may be okay in rare instances, I recommend monthly reconciliations to my clients.

Why? The sooner you detect any discrepancies or errors, the easier it is to address them. By staying on top of your accounts monthly, you minimize the risk of encountering more significant issues, making the cleanup process much smoother.

Create an Organizational System for all Documents

Establish a method for organizing and storing your financial documents, whether digital or physical. Create dedicated folders for invoices, receipts, bank statements, and any other vital paperwork to ensure convenient access and retrieval when needed.

I suggest utilizing software tools like Hubdoc, which can automatically fetch bills for you, and receipt management software, which simplifies capturing receipts by allowing you to snap photos and upload them to a cloud storage service for effortless management and safekeeping.

Review your Accounts Receivable and Payables Regularly

Reviewing your accounts receivable and payables is essential for maintaining healthy cash flow and financial stability in your business.

Monitoring accounts receivable allows you to keep track of outstanding payments and ensure that pending invoices are promptly settled, preventing cash flow disruptions.

Similarly, monitoring accounts payables helps you manage outgoing payments effectively, avoid late fees, and maintain positive relationships with vendors and suppliers.

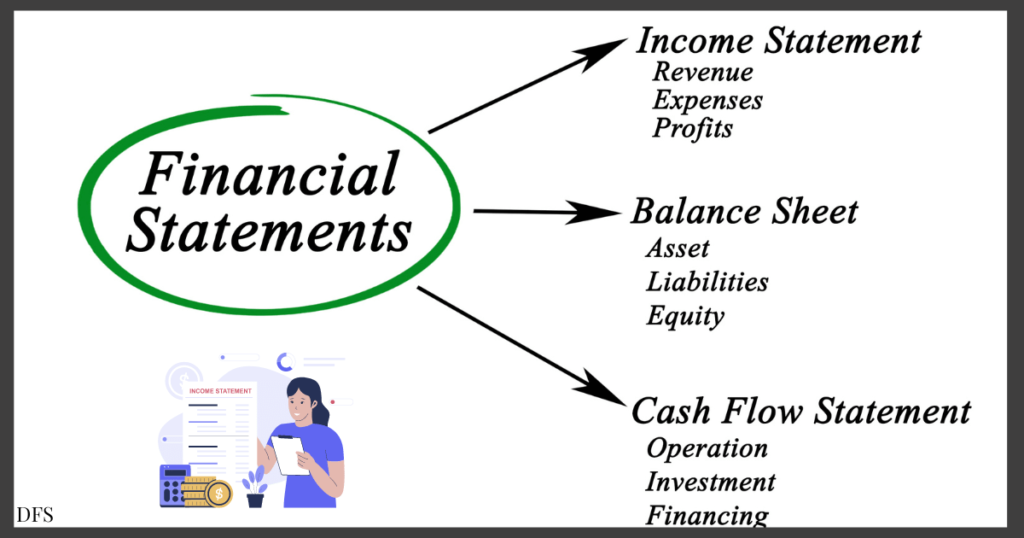

Review your Financial Reports

And lastly, review your financial reports. In your reports you will find a comprehensive overview of your business’s financial health, showing where you stand currently, how you’ve been performing, and what to expect in the future.

Use your accounting software to generate the three essential financial reports: income statements, balance sheets, and cash flow statements. These reports provide insights into your business’s performance, highlighting strengths and areas needing attention.

Getting into the habit of regularly reviewing these reports helps you make informed decisions, identify growth opportunities, and manage risks effectively for long-term success, and in the case you don’t have the time to do this or simply rather outsource this part of your business, look into hiring a professional bookkeeper.

Final Thoughts

In wrapping up, you’re now armed with the essential knowledge needed to kickstart effective bookkeeping practices for your new small business. By understanding the importance of bookkeeping, recognizing its benefits, and implementing practical steps, you’re on track to financial success.

Remember, bookkeeping is not just about crunching numbers—it’s about gaining insights, making informed decisions, and steering your business toward growth. So, embrace the journey ahead, and don’t hesitate to reach out if you need further guidance or support.

Here’s to your success!

FAQ’s

Can I Use Bookkeeping Software Even if I’m Not Tech-Savvy?

Yes, many bookkeeping software options are designed to be user-friendly, even for those with limited technical expertise. These platforms often provide step-by-step guidance and customer support to help you navigate the software and manage your finances effectively.

How Can I Differentiate Between Expenses That Are Deductible and Those That Are Not for Tax Purposes?

Deductible expenses are those considered necessary and ordinary for conducting business operations. These may include costs related to supplies, utilities, rent, and employee salaries. On the other hand, non-deductible expenses are personal expenses or those unrelated to business activities. It’s important to keep accurate records, and if you’re ever in doubt, consult with a bookkeeper or tax professional to determine which expenses are deductible for your business.

Should I Outsource My Bookkeeping?

If you struggle to keep up with categorizing transactions and reconciling accounts, or if you’re unsure about the accuracy of your categorizations and find financial reports challenging to understand, outsourcing bookkeeping could be a wise decision. Professional bookkeepers can offer expertise and efficiency in managing your financial records, ensuring accuracy, compliance, and clarity in your financial reporting.

Entrusting your bookkeeping to experts can alleviate the stress and burden of these tasks, allowing you to focus on other aspects of your business with confidence and peace of mind.