Contractors Best Way to Organize Receipts in 2024

Does the thought of sorting through your receipts overwhelm you? If so, trust me—I’ve been in your shoes.

Having worked hands-on in the construction field myself—and I don’t mean office work; I’m talking about getting down and dirty with the tools, in the trenches, and on the ground—I’ve been in your shoes. I know firsthand how many tasks you’re already juggling, and spending extra hours sorting and organizing your paper receipts is the last thing you want to do.

But here’s the good news: it doesn’t have to be a pain. With a bit of direction, organization, and consistency, this part of your business will no longer be a reason to stress over.

In this article, I’ll outline actionable steps to help you organize and maintain your receipts in excellent condition. If you’re looking for other ways to save time and increase efficiency with your office duty tasks, check out my article, which covers 22 ways to improve your bookkeeping process.

Key Takeaways:

- Digitize your receipts using cloud-based storage platforms.

- Getting organized and separating receipts by job.

- Implement a consistent receipt workflow to stay organized, save time, and prevent a backlog of receipts.

It’s Time to Digitize.

As a professional bookkeeper, I’ve often encountered clients turned away by their accountants simply because they arrived with a box of receipts or spreadsheets of information.

But guess what? Those days are over! It’s time to digitize your receipts.

By electronically storing your receipts, you can streamline your record-keeping process and access your expense information with just a few clicks. Now, doesn’t that sound wonderful?

Plus, by eliminating the paper clutter in your truck or office, staying organized becomes a breeze, tax time becomes much easier, and the hours spent sorting through receipts are gone.

It’s never been easier with software like Dext and Expensify, which are web-based apps. With these receipt tracking apps, you snap a picture of your receipt to upload it to the cloud, and ta-da! You’ve gone digital!

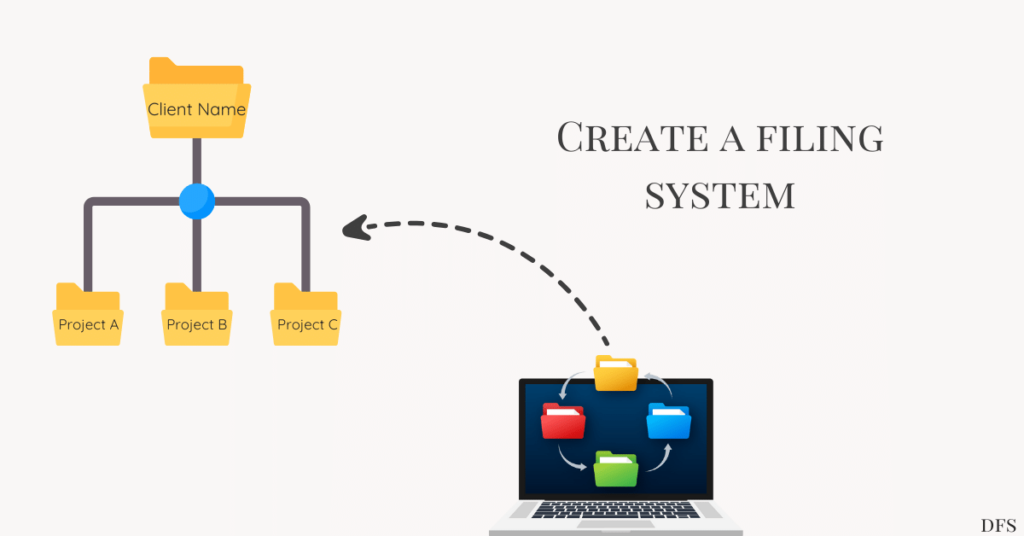

Establish an Organized Filing System

Once you’ve selected the software to capture your receipts, the next step is creating a system to store everything.

Given this article’s focus on digital solutions, I recommend utilizing cloud-based storage platforms like OneDrive, Dropbox, or Google Drive. These platforms offer secure, accessible storage for your receipts, allowing you to access them anywhere with an internet connection and reduce paper clutter.

Also, considering that the IRS mandates the retention of receipts for seven years, leveraging these cloud-based storage platforms can guarantee meticulous record-keeping and provide the flexibility to download all receipts onto a backup hard drive for permanent storage.

So, take this opportunity to establish a structured filing system within your chosen platform. Organize your folders according to different departments within your business and clients’ names, ensuring each receipt finds its proper place.

Create a Folder per Job: Digitally and Physically.

Separating your expense receipts by job is not just a recommendation; it’s a requirement. This step is crucial because it is a big part of your business’s success.

With this level of detail, you can accurately track expenses related to individual projects, including materials, labor, and any other associated costs. This information can also help you analyze each job’s income and expenses, identify cost-saving areas, learn how to adequately price future jobs, and make informed decisions to improve your overall financial success.

I mentioned having a physical folder or location to store these receipts because this is the first location where you or your team will store these receipts.

How you store your physical receipts will be a matter of personal preference. Choose what works best for you: file folders, a receipt binder, or a yellow envelope.

This organizational strategy will help you keep all the documents you’ll need together per job, saving you time from having to sort through a bunch when the time comes to upload them to the cloud.

But make sure you have a folder per project somewhere in your vehicle. There will be occasions when you won’t have the time to scan them right away, and you need to keep your records organized since it’s common for contractors to work on multiple projects simultaneously.

Create a Receipt Workflow.

You’ll want to prioritize this part of receipt management and make it a habit. You’ll notice how much time you can save by maintaining consistency with your organization system. Here’s a workflow to help you kickstart the process, which you can adjust as needed.

Step 1. File the Paper Copy

When you receive a receipt, place it in your designated filing area in your vehicle and/or office. Whether it’s a folder, envelope, or binder, having a specific spot to store receipts ensures they will be found.

Step 2. Upload the Receipt to the Cloud.

If you work with a team, take a picture of all receipts at the end of your shift. Aim to capture images of all receipts at the end of each workday. This ensures you have a digital receipt and backup if the physical copies are lost or damaged.

For solopreneurs, photograph receipts at the end of the week: If you’re running your contracting business alone, it’s good practice to do this every day, but let’s be honest, you already have many other things on your plate, so at the very least set aside time at the end of each week to snap pictures of all receipts accumulated during that time. It’s easy to lose receipts, but this routine helps maintain consistency and prevents a backlog of receipts from piling up or getting lost.

Step 3. Review the Receipt and Store It in the Appropriate Virtual Folder.

After you upload receipts to the cloud, they await review. This means they sit in a central place until you decide which folder they belong to.

Try to do this once a week, at the very least. Construction moves quickly, and stuff piles up fast. If by any chance you don’t have the time to get to this on a weekly basis, you can easily get someone on your team to handle this for you or hire a pro to help you and save time.

In Conclusion

Embracing these simple changes can significantly improve the ease and efficiency of your life.

By transitioning to organizing receipts electronically and implementing receipt organization workflows, you’ll discover a newfound sense of ease in your daily operations.

Remember, the equation is simple: organization leads to efficiency, which in turn boosts productivity, creates room for growth, and ultimately enhances profitability.

FAQ’s

How Long Should Contractors Retain Receipts for Tax and Audit Purposes?

You should retain receipts for seven years to comply with tax regulations and potential audits.

Can Contractors Deduct Expenses Without Receipts?

It can be challenging to deduct expenses without receipts, as receipts are proof of the cost. While the Internal Revenue Service (IRS) allows for certain deductions based on other forms of documentation, such as bank statements or credit card statements, having receipts provides more concrete evidence and strengthens the legitimacy of the deduction. Without receipts, you may face difficulties during tax audits or if questioned by tax authorities regarding the validity of claimed expenses.

How Can Contractors Safeguard Digital Receipts Against Loss or Unauthorized Access?

You can protect digital receipts by utilizing secure cloud storage platforms like OneDrive or Dropbox with strong passwords and enabling two-factor authentication. Encrypting sensitive data before uploading adds an extra layer of security. Regular backups, stored securely in separate locations, mitigate data loss risks. Restricting access permissions to authorized individuals and monitoring account activity for suspicious behavior further enhances security.